- Arbitrum DAO needs to be careful how it allocates its $42 million ecosystem grant.

- Binance's gas spending spree confuses onlookers.

- The debate over DAO risk management heats up.

A version of this story appeared in our The Decentralised newsletter. Read this and our other newsletters before your friends do by signing up here.

Hey, Tim here.

I’m looking at two big onchain spenders this week — Arbitrum DAO and Binance, and how these two organisations are splashing their cash.

As Osato Avan-Nomayo explored, Arbitrum DAO voted to give away $42 million from its coffers to help boost ecosystem growth on the layer 2 blockchain.

In a bull market, such news would barely make headlines. But right now, few DAOs are in a position to be giving away millions.

Optimism, Arbitrum’s biggest rival, unveiled a surprise sale of $157 million worth of its OP token without a DAO vote, in what appeared to be a desperate bid to raise cash.

The sale — undemocratic as it was — left the Optimism community and token holders understandably miffed.

In comparison, Arbitrum is looking strong.

The battle for Ethereum’s layer 2 will likely be a winner-takes-all scenario.

Liquidity begets liquidity, and right now, Arbitrum’s not just in pole position, it’s dominating the competition.

But Arbitrum needs to be careful.

How its community decides to allocate the $42 million will be crucial to keeping its momentum. DAO ecosystem funding has a disastrous history of abuse and misuse — just ask Harmony.

Also spending big is Binance, but in a very different way. The top centralised exchange blew over $840,000 on Ethereum gas fees in just 20 minutes shuffling tokens between its wallets.

So why did Binance submit hundreds of simultaneous transactions and pump gas fees to insane levels? We’re not even sure Binance itself knows.

The exchange told us the transactions were part of a “routine consolidation,” and that the impact to gas prices was “unintentional.”

Onlookers, including Gnosis CEO Martin Köppelmann, were quick to point out that Binance had overpaid for the transactions. If the exchange had spread those transactions out, it could’ve avoided spiking Ethereum gas and paid a lot less.

Gas prizes spiking because of a ton of regular ETH transfers related to Binance.

— koeppelmann.eth 🦉💳 (@koeppelmann) September 21, 2023

a) they are using a really inefficient script to consolidate funds and are massively overpaying transaction costs

b) something fishy is going on

Such wasteful actions really aren’t a good look for Binance, which has a few other problems on its plate.

If intentional, it shows the exchange doesn’t care about blowing close to a million dollars for no good reason.

On the other hand, if the transactions were unintentional, it implies Binance’s operations are disorganised and chaotic — which would be pretty worrying for an exchange handling over $56 billion of customer assets.

In other news, I talked DAO risk management with B.Protocol’s Eitan Katchka and Synthetix Spartan Council member Millie.

B.Protocol wants to help fledgling DAOs better manage their risk with algorithms, helping create a safer DeFi ecosystem. But Millie argued that risk management requires in-depth knowledge of specific protocols and so should only be handled by humans.

Risk management is super important for DAOs to get right, as the situation with Michael Egerov’s CRV-backed loans on Aave recently revealed.

There are compelling arguments both for and against the automation of risk management.

Join Millie, B.Protocol’s Yaron Velner and me on a Wednesday X Spaces where we’ll continue the humans vs code debate.

Data of the week

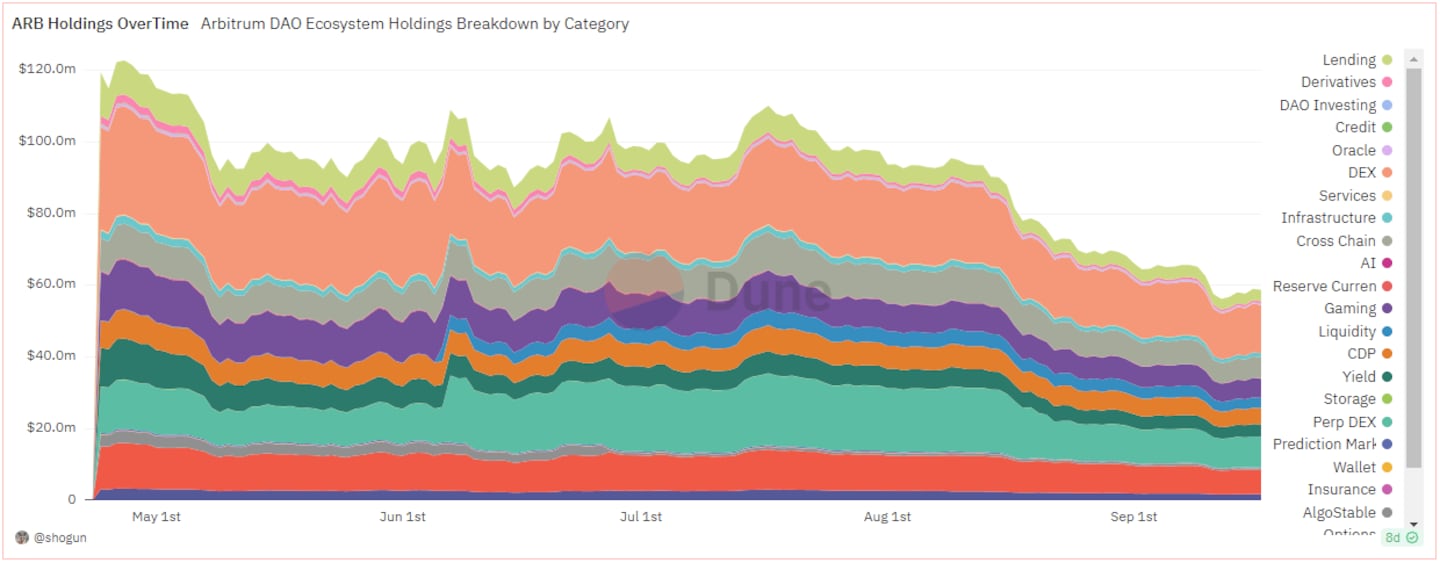

Arbitrum distributed over $100 million worth of ARB tokens to protocols building on the layer 2 as part of its token airdrop earlier this year. As the chart shows, the value of ARB held by protocols has dropped about 40%.

How much of this decline was due to these protocol selling their ARB is unclear.

But it’s no secret that Arbitrum DAOs $42 million worth of ecosystem grants will put additional selling pressure on the ARB token.

This week in DeFi governance

PROPOSAL: Blockworks Research suggests changes to ATOM tokenomics

PROPOSAL: Kindnesss.eth builds new token database on ENS

VOTE: Aave to greenlight v3 deployment on Gnosis Chain

Post of the week

There’s a new top-valued Friend.tech user this week after @vombatus_eth spent almost 1,000 Ether, or $150,000, to buy 326 of his own keys.

No one really knows why Vombatus spent so much to pump the price of his key, but the event caused quite a stir on social media.

Crypto cartoonist BoldLeonidas thinks Vombatus might just be following some sound advice a little too literally.

NFA @Vombatus_eth pic.twitter.com/M6sCOzFRVh

— Bold (@boldleonidas) September 25, 2023

What we’re watching

Still zero visibility on when season 2 will end.

— Stats (@punk9059) September 19, 2023

And another 49mn $BLUR ($8.3mn) was paid out to insiders (investors, advisors, team) last week while farmers wait.

Farmers who bought NFTs via Blur bids have over 45,000 ETH of realized losses since Season 2 started.

The… pic.twitter.com/E9ApoYsX43

After dethroning OpenSea as the top NFT marketplace in early 2022, Blur could be running out of steam. The promise of a second token airdrop has helped Blur keep trading volume high. But, as @punk9059 points out, the conflict of interest between users and the Blur team is palpable.

We plan to dive into NFT trading data to see just how well Blur is doing. Be sure to catch our upcoming piece on the topic — the findings might surprise you.

Have you joined our Telegram channel yet? Check out our News Feed for the latest breaking stories, community polls, and of course — the memes. https://t.me/dlnewsinfo

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out to him with tips at tim@dlnews.com.

Disclosure: Tim holds over $1,000 worth of Ether, Swell staked Ether, Redacted Cartel, and GMX. He also holds an insignificant amount in NFTs.