- AltLayer’s token airdrop faced community backlash over perceived unfairness in distribution.

- Some users received as much as $135,000 for holding a specific AltLayer community NFT.

- Similar issues have arisen in previous airdrops, indicating challenges in achieving equitable token distributions.

AltLayer is tackling concerns over the distribution of ALT tokens in its recent airdrop that released over $100 million, which notably benefited holders of the AltLayer community NFTs.

The protocol’s head of business development, Dorothy Liu, took to X to hit back at community grievances, calling the profitable timing a “coincidence” and saying it is “quite normal for a degen trader to take profits after unusual price actions.”

“I understand the concerns that have been raised among the AltLayer community that has given us so much support since the start of the project,” Liu wrote. “And I am sorry that this affected our community, to which I remain fully committed.”

Generally, airdrops are a surefire way for new projects to attract users and liquidity while attempting to decentralise the protocol.

But the saga underscores the complexities and challenges of executing large-scale token distributions in a way that is perceived as fair and equitable by the community.

What happened

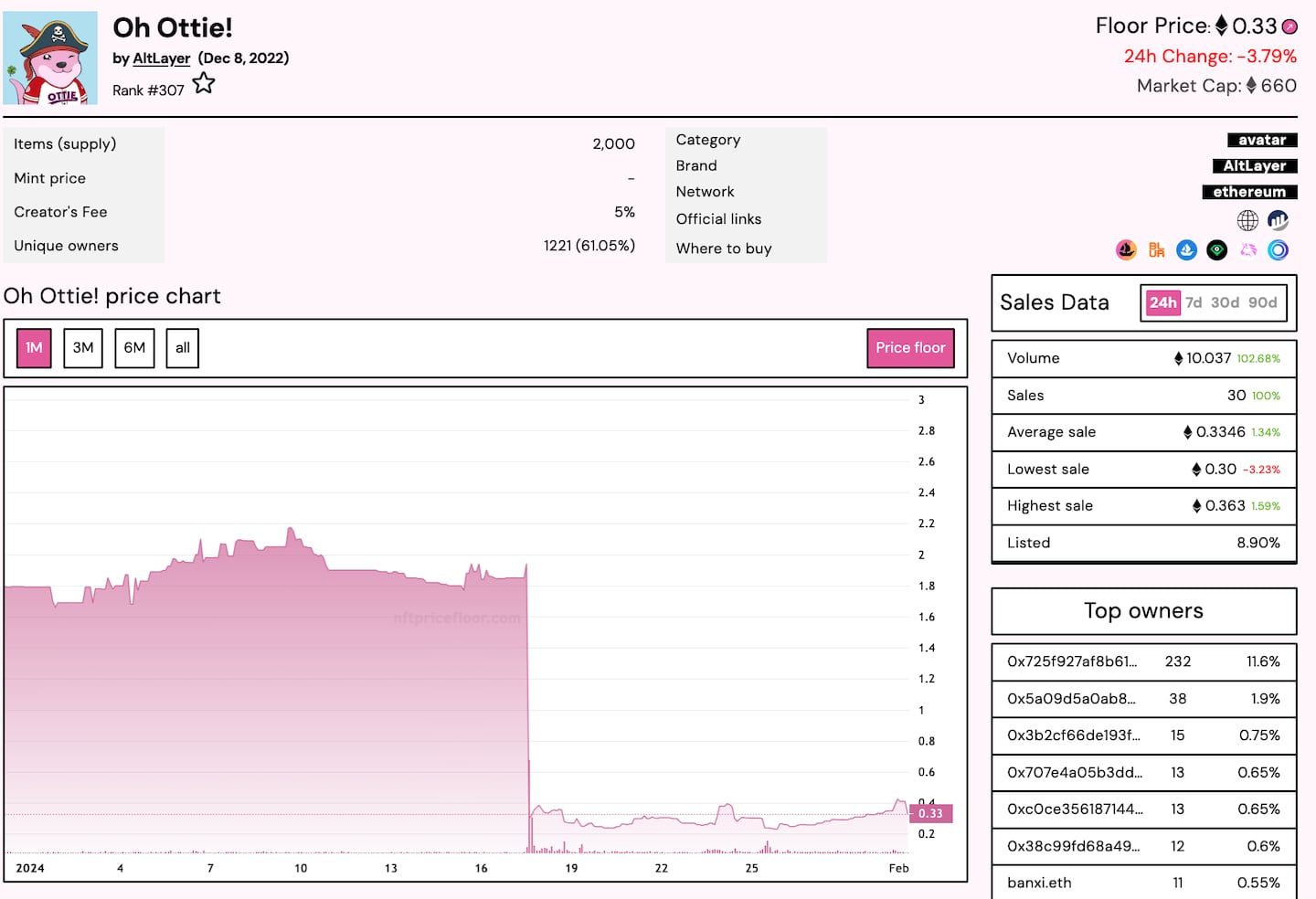

The Oh Ottie! and OG Badge NFTs were NFTs created by the AltLayer team to increase community engagement and were slated to receive allocation in the future ALT airdrop.

The airdrop distributed $100 million to over 550,000 users, but a majority of the value was concentrated to a minority of users, prompting a deeper look into the distribution.

According to onchain transactions, one wallet, 0x42, purchased an Oh Ottie! NFT in March 2023 before receiving a second one from doro.eth, Dorothy’s ENS address, in May.

This address then went on to purchase an OG Badge NFT on December 24.

All three of these NFTs owned by 0x42 were listed just prior to the official snapshot — a data tally to determine who is eligible to receive tokens. But all three sold after the snapshot, making the wallet eligible for the ALT token airdrop.

The 0x42 address received 322,938 ALT — worth $135,000 — before sending these funds to Binance, a centralised crypto exchange typically used for off-ramping.

These wallet activities, particularly receiving the Oh Ottie! NFT from doro.eth, prompted one pseudonymous trader, known by Puuurif, to raise concerns about the connections.

Dorothy’s response explained that “as the main promoter of Otties, I bought a number of Otties at 0.3-0.59e to gift my friends one year ago. One of them is @mulan_0x.”

She went on to further explain the listing of these NFTs so close to the time of the snapshot:

“It’s a coincidence that it’s close to the announcement date, unfortunately,” saying she wasn’t aware of the exact Binance listing date and timing of the announcement.

“And it would be quite normal for a degen trader to take profits after unusual price actions for an illiquid NFT collection,” Liu wrote.

Still, although the activities of the 0x42 wallet have been explained, the overall distribution and activity of some of the top ALT airdrop recipients raises further questions.

Uneven distribution?

The airdrop’s structure was tier-based, with eligibility and allocation varying across different groups. The largest group included over 467,000 users who participated in the Altitude Campaign, an effort to get users to try out AltLayer’s test network. Collectively this group received 111 million ALT tokens.

The second largest group received around 30 million ALT tokens and was made up of nearly 95,000 users who staked Celestia’s native token TIA. Celestia is a modular data availability network that will be utilised by AltLayer.

Over 28,000 users staking on EigenLayer, an Ethereum native protocol that introduces restaking, received 39 million ALT tokens. AltLayer is using EigenLayer’s restaking mechanism to increase its security.

Additionally, 2,000 holders of Oh Ottie! NFTs received 31,610 ALT for each NFT held at the time of the snapshot, a total of 63 million ALT.

These NFTs were first available over two years ago at a price of 0.08 ETH. Just before the snapshot on January 17, they were trading at 2.48 ETH.

Finally, AltLayer OG Badge NFT holders, a smaller group of 400, received a substantial 52 million ALT. The badges traded as high as 7.65 ETH moments before the snapshot announcement, but now trade at 2.18 ETH.

Particularly contentious was the allocation to the AltLayer OG Badge NFT holders, who received nearly 130,000 ALT, or $53,000 each.

Notably, 100 of the OG Badge NFTs were reserved for team members, backers, and crypto influencers.

Scrutiny intensified when blockchain analytics firm Arkham Intel highlighted that the seven largest airdrop recipients acquired their tokens predominantly through these badges, with most selling their ALT shortly after the airdrop.

It is possible those seven users bought the badges solely based on a Medium article released by the AltLayer team in July 2022, which clearly stated these NFTs would receive future airdrops.

But it was never clear exactly how much they would receive.

Speculations and scrutiny

The situation was complicated by on-chain transactions seen by DL News that show a number of wallets that listed their NFTs minutes before the snapshot announcement.

The observations were first spotted by pseudonymous user WazzCrypto, who flagged the transactions on X.

Due to the thinly traded nature of these NFTs, most of these NFTs were not sold until after the snapshot announcement. As a result, these users were still eligible for the airdrop.

The controversy was further fueled by the similar transaction histories of the top three airdrop recipients, all of which were first active in late July 2022, had between 30 to 40 total transactions, and had claimed the Blur airdrop.

Ultimately, it is unclear what could have caused these wallets to act in such alignment.

AltLayer’s Liu did not address these transactions in her X post explanation, and she did not respond to DL News’ requests for further comment.

AltLayer told DL News that some online criticism about the timing of the airdrops has been retracted.

“This entire matter was put to rest by the crypto ‘accusers’ themselves by the end of last month and notably - they apologized for misunderstanding the context,” an AltLayer spokesperson said in an email to DL News.

A pattern of discontent

The ALT airdrop criticism over what appears to be uneven distribution is not an isolated case.

Similar dissatisfaction was observed with the Manta and Jito airdrops, where distribution mechanisms led to frustration among different groups of investors.

With the Manta airdrop, rare NFT holders felt shortchanged, while the Jito airdrop drew ire from larger investors who felt their early risks were underappreciated.

Manta and Jito did not respond to DL News’ requests for comment about the complaints at the time.

This article was updated on February 9 to include AltLayer’s comments about the criticism and to clarify that Dorothy’s name is not a pseudonym. Her full name and title has been included.

Ryan Celaj is DL News’ New York-based Data Correspondent. Reach out with tips at ryan@dlnews.com.