- Vitalik Buterin presents an alternative to Tornado Cash.

- Elsewhere, the embattled crypto tumbler may have a new defence as it fights the Feds in courts.

- This, and much more in this week’s edition of The Decentralised newsletter.

A version of this story appeared in our The Decentralised newsletter. If you want to read this or our other newsletters before your friends do, don’t hesitate to sign up.

Hey everyone, Tim here.

Welcome back to The Decentralised, where we bring you a tour d’horizon of the top DeFi news.

Starting off, Osato Avan-Nomayo continued to cover DAO rage quits, focusing this week on Concave Finance.

Concave’s developers agreed last week to pay $2.1 million from its treasury to aggrieved investors — but something went horribly wrong.

The smart contract governing how much investors could claim was bugged, resulting in just a handful of early claimants taking the whole pot, leaving everyone else with nothing.

As you might expect, Concave token holders who missed out on the liquidation were less than pleased.

“It’s no one’s but the team’s fault,” Robster, a pseudonymous crypto personality and founder of Telegram crypto channel Antirug, told DL News.

Concave’s TVL, or total value locked, sits at around $500,000 — down from $16.5 million in April 2022.

A DAO rage quit refers to the partial or total liquidation of a project’s treasury and the subsequent distribution of the funds to investors.

Rage quits sometimes occur in tandem with hostile DAO takeovers, where activists turn a profit by buying up a DAO’s governance token then vote to liquidate the project’s treasury.

Read the full story here to find out about the series of events that led to Concave’s rage quit.

Next, Aleks Gilbert followed up on his previous Tornado Cash piece covering the indictment of founders Roman Storm (left) and Roman Semenov (centre) with another exploring how the pair may fight the Feds in court.

Although US prosecutors built their case on the assertion that Tornado Cash should be classed as a money transmitter, previous guidance issued by FinCEN appears to establish that it isn’t.

According to several crypto lawyers and lobbyists, Storm and Semenov could use this loophole to fight their case. However, crypto lawyer Gabriel Shapiro told DL News that the industry should “rebut the govt’s strongest possible case,” not a watered-down strawman version.

Check out Aleks’ full article here for expert comments on how the Tornado Cash case could impact the rest of DeFi.

On the topic of Tornado Cash, I covered a new academic paper from five crypto heavyweights — including Ethereum’s Vitalik Buterin — exploring an alternative privacy protocol called Privacy Pools.

Privacy Pools attempts to fix the most critical flaw in Tornado Cash: honest users wanting privacy can’t prove their funds didn’t come from an illicit source. It does this using zero-knowledge proofs — an advanced cryptographic technique that allows blockchains to prove that something is true, without revealing anything about it.

DL News spoke to pseudonymous Tornado Cash developer Theo. He said he’s positive about the ideas discussed in the paper, and would try them out if Privacy Pool’s creators can prove they work at scale.

Read the full article here to learn how Privacy Pools aims to exclude bad actors while safeguarding the privacy of honest users.

Data of the week

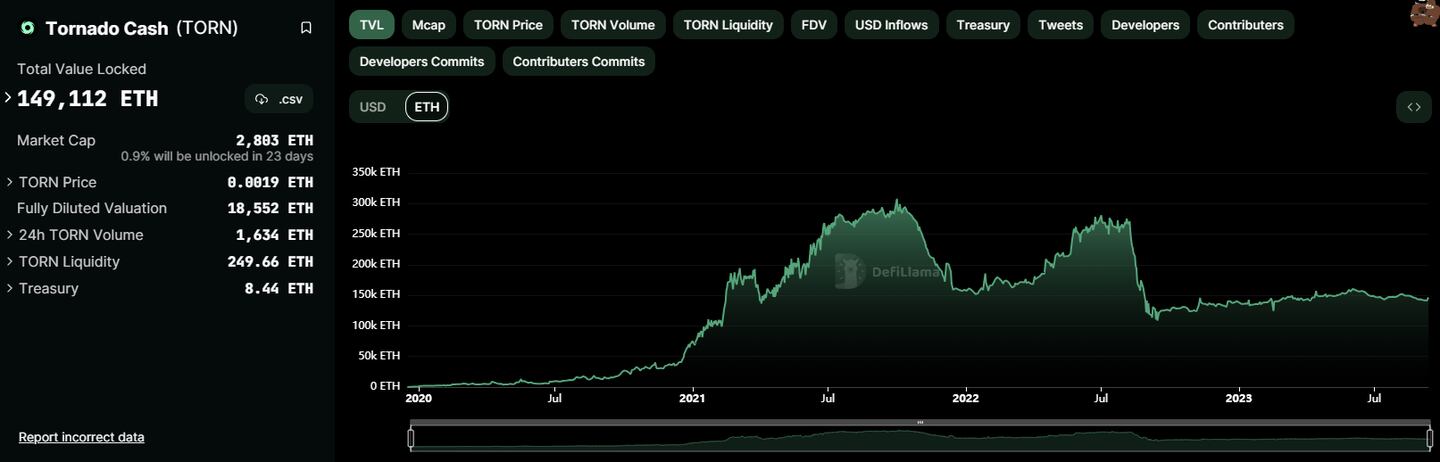

Deposits to Tornado Cash’s pools dropped sharply following last August’s OFAC sanctions against the protocol. However, in the months since, deposits have actually increased in Ether-denominated terms.

This week in DeFi governance

PROPOSAL: dYdX discusses V4 launch incentives

Chaos Labs proposes a six-month launch incentives programme ahead of dYdX’s move to its own Cosmos-based blockchain. The chain switch is likely to be disruptive, so ensuring users and liquidity providers are incentivised to move over swiftly is essential to keeping the trading platform running smoothly.

VOTE: Arbitrum DAO decides incentive programme amount

The Arbitrum DAO is voting on how many ARB tokens it will allocate to a one-time, community-created grants programme. So far, voters favour the smallest allocation of 25 million ARB. But with six more days of voting, this could still change.

PROPOSAL: Lido’s Solana deployment asks the DAO for more funding

P2P team, who are maintaining Lido’s deployment on Solana, are asking for $1.5 million of additional funding to continue their operations over the coming year. In that time they hope to grow Lido to 1% of Solana staking market share.

Post of the week

X user @_via_getty_ riffs on the running gag that DeFi developer Laurence Day (@functi0nZer0) is the mastermind culprit behind every major DeFi hack. The chart actually shows the yearly amounts stolen in crypto hacks by North Korean crime syndicate Lazarus Group.

we must solve the skill issue pic.twitter.com/HupqoPLK3J

— getty (@_via_getty_) September 8, 2023

What we’re watching for next week

FriendTech trading volume was $12.3M yesterday.

— TylerD 🧙♂️ (@Tyler_Did_It) September 10, 2023

Total NFT trading volume on ETH was just $9.15M. pic.twitter.com/CbqVYqP5PQ

Friend.tech gains its second wind: activity on the popular protocol that lets X users buy and sell shares of accounts is on the rise again. On Sunday, trading volume of Friend.tech shares outpaced all NFT trades on Ethereum.

Have you joined our Telegram channel yet? Check out our News Feed for the latest breaking stories, community polls, and of course — the memes. https://t.me/dlnewsinfo

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out to him with tips at tim@dlnews.com.

Disclosure: Tim holds over $1,000 worth of Ether, Swell staked Ether, Redacted Cartel, and GMX. He also holds an insignificant amount in NFTs.